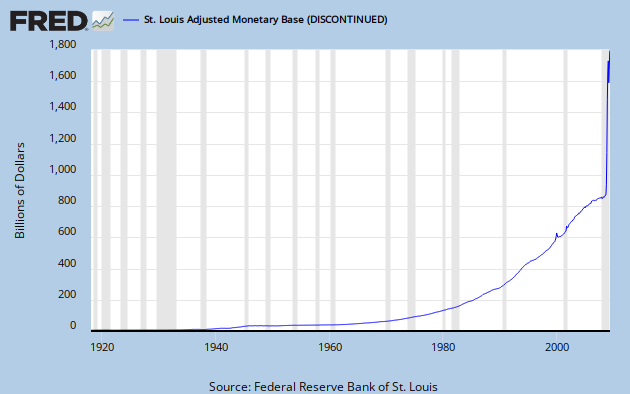

Reason #4 – The devaluing of our currency is an economic and moral nightmare.To be clear, this is a graph of the amount of money that the Federal Reserve Bank has printed and is currently in circulation in the United States of America.

The Federal government has pumped so much cash into the economy over the past 6 months that it would seem altogether impossible for this action not to result in inflation, at best, or hyperinflation, at worst. Either outcome is harmful to American and its citizens and should be avoided by all means necessary. At this point, the question is how to begin reducing the amount of currency in circulation and the answer is one that the Federal government refuses to accept: let the free market correct itself and determine the true value of the dollar. While such action will undoubtedly lead to tougher times ahead, this correction is necessary to overcome the mistakes of our past and ensure that we are standing on solid financial ground in the future.

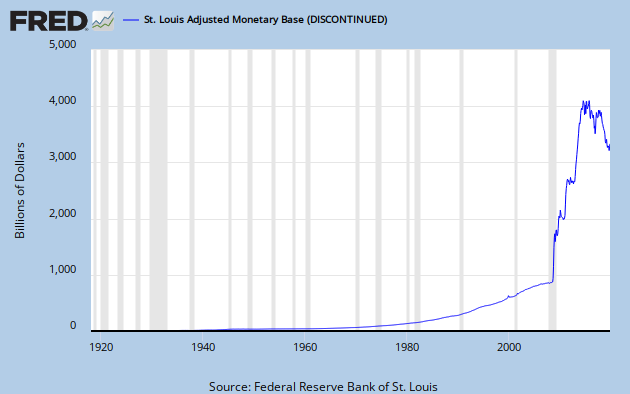

Here's the status as of today:

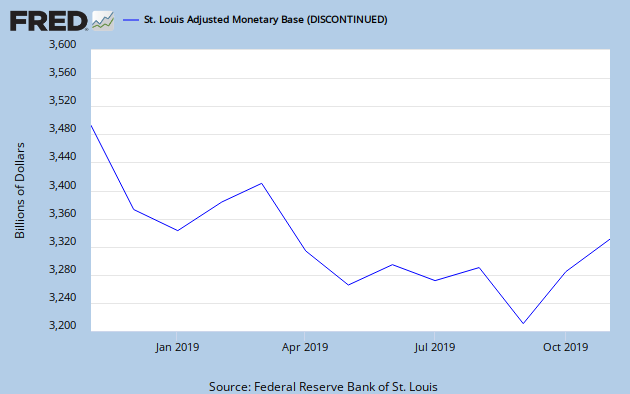

In order to bring more clarity to the ongoing devaluing of the dollar, below is the activity of only the last year, so we can see the atrocity up close:

Who says you can't spend what you don't have? Our government does just that and then prints more money to reduce the deficit between their spending versus available funds. I fully anticipate to see this line continuing to trend upward, much to my dismay and as an ever-increasing, impending threat to our nation's economic security.

No comments:

Post a Comment